Stonewell Bookkeeping Fundamentals Explained

Wiki Article

The smart Trick of Stonewell Bookkeeping That Nobody is Talking About

Table of ContentsThe Ultimate Guide To Stonewell BookkeepingExcitement About Stonewell BookkeepingNot known Details About Stonewell Bookkeeping 5 Simple Techniques For Stonewell BookkeepingThe Definitive Guide to Stonewell Bookkeeping

Right here, we address the inquiry, just how does accounting aid an organization? In a sense, audit publications represent a snapshot in time, yet only if they are updated often.

None of these verdicts are made in a vacuum cleaner as accurate numeric information must copyright the financial decisions of every tiny organization. Such information is assembled with bookkeeping.

Still, with proper capital management, when your publications and journals depend on day and systematized, there are far fewer concern marks over which to stress. You understand the funds that are readily available and where they fail. The news is not always great, but a minimum of you know it.

9 Easy Facts About Stonewell Bookkeeping Described

The puzzle of reductions, credit histories, exemptions, schedules, and, naturally, penalties, suffices to just give up to the IRS, without a body of well-organized paperwork to support your cases. This is why a devoted accountant is vital to a small company and is worth his/her king's ransom.

Your service return makes cases and depictions and the audit aims at validating them (https://www.40billion.com/profile/149645899). Excellent bookkeeping is all concerning connecting the dots in between those depictions and truth (White Label Bookkeeping). When auditors can adhere to the details on a ledger to receipts, bank statements, and pay stubs, among others files, they swiftly learn of the proficiency and integrity of business organization

The 9-Second Trick For Stonewell Bookkeeping

Similarly, slipshod bookkeeping includes in stress and anxiousness, it also blinds company owner's to the potential they can realize in the long run. Without the information to see where you are, you are hard-pressed to set a destination. Just with reasonable, thorough, and valid data can a company owner or management group story a course for future success.Local business owner recognize best whether an accountant, accountant, or both, is the appropriate option. Both make important contributions to a company, though they are not the exact same profession. Whereas an accountant can gather and arrange the information required to support tax preparation, an accountant is better matched to prepare the return itself and really examine the income statement.

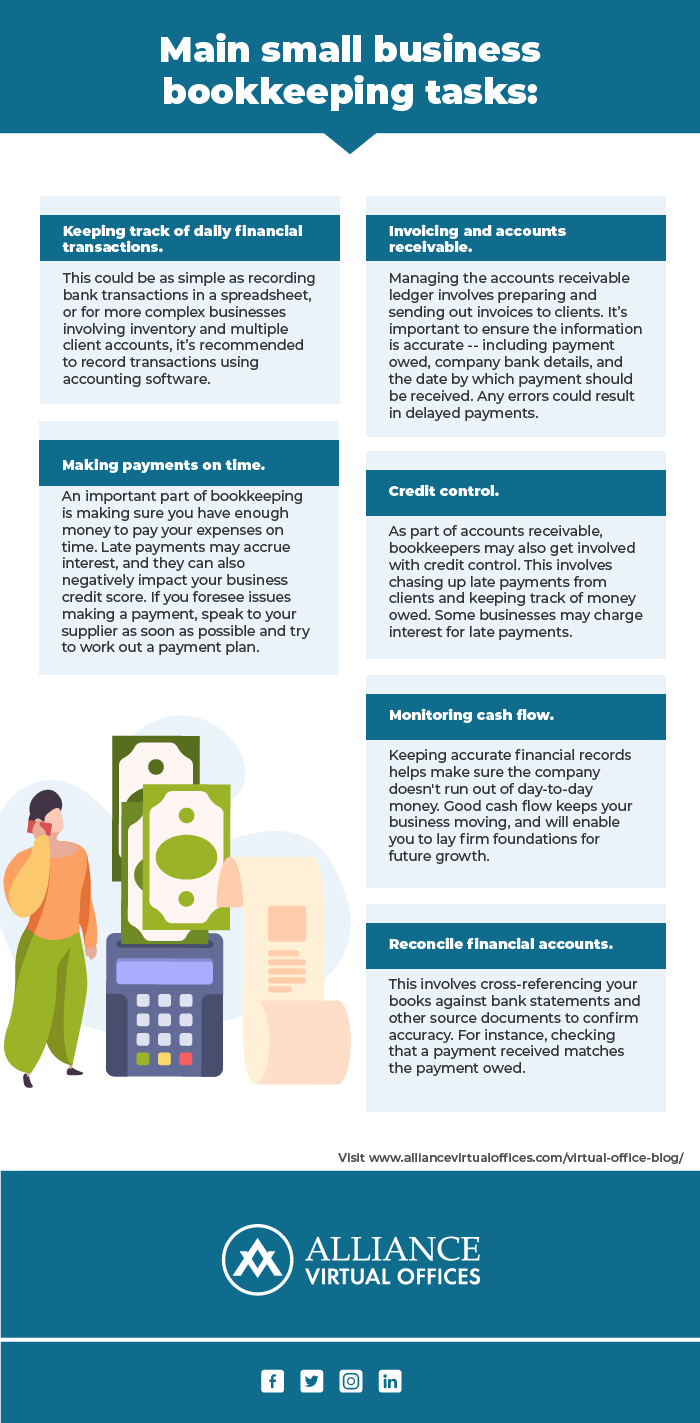

This short article will delve right into the, consisting of the and how it can profit your service. We'll likewise cover exactly how to get going with bookkeeping for an audio economic footing. Bookkeeping includes recording and organizing financial deals, including sales, acquisitions, payments, and receipts. It is the procedure of keeping clear and succinct documents to ensure that all monetary information is conveniently obtainable when required.

This short article will delve right into the, consisting of the and how it can profit your service. We'll likewise cover exactly how to get going with bookkeeping for an audio economic footing. Bookkeeping includes recording and organizing financial deals, including sales, acquisitions, payments, and receipts. It is the procedure of keeping clear and succinct documents to ensure that all monetary information is conveniently obtainable when required.By on a regular basis upgrading monetary records, accounting aids companies. This assists in click to investigate quickly r and conserves organizations from the tension of looking for files during deadlines.

The Definitive Guide for Stonewell Bookkeeping

They are mainly concerned concerning whether their money has been used properly or not. They certainly would like to know if the company is making cash or otherwise. They additionally need to know what capacity the service has. These aspects can be quickly taken care of with bookkeeping. The revenue and loss statement, which is prepared routinely, shows the earnings and also figures out the possible based upon the revenue.Therefore, accounting aids to avoid the headaches associated with reporting to capitalists. By maintaining a close eye on financial records, services can establish sensible goals and track their development. This, in turn, promotes much better decision-making and faster organization growth. Federal government laws typically call for businesses to keep economic records. Routine accounting guarantees that services stay compliant and avoid any type of charges or lawful concerns.

Single-entry bookkeeping is straightforward and functions ideal for tiny companies with few purchases. It includes. This technique can be compared to maintaining a straightforward checkbook. Nonetheless, it does not track possessions and responsibilities, making it less detailed contrasted to double-entry accounting. Double-entry accounting, on the other hand, is extra advanced and is typically considered the.

Our Stonewell Bookkeeping Statements

This might be daily, weekly, or monthly, depending upon your service's size and the quantity of purchases. Don't wait to look for help from an accounting professional or bookkeeper if you locate managing your monetary documents challenging. If you are searching for a complimentary walkthrough with the Accountancy Service by KPI, call us today.Report this wiki page